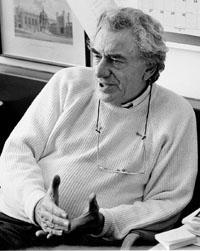

Hyman Minsky (Hyman Phillip Minsky)

Hyman Minsky proposed theories linking financial market fragility, in the normal life cycle of an economy, with speculative investment bubbles endogenous to financial markets. Minsky claimed that in prosperous times, when corporate cash flow rises beyond what is needed to pay off debt, a speculative euphoria develops, and soon thereafter debts exceed what borrowers can pay off from their incoming revenues, which in turn produces a financial crisis. As a result of such speculative borrowing bubbles, banks and lenders tighten credit availability, even to companies that can afford loans, and the economy subsequently contracts. This slow movement of the financial system from stability to fragility, followed by crisis, is something for which Minsky is best known, and the phrase “Minsky moment” refers to this aspect of Minsky’s academic work. “He offered very good insights in the ’60s and ’70s when linkages between the financial markets and the economy were not as well understood as they are now,” said Henry Kaufman, a Wall Street money manager and economist. “He showed us that financial markets could move frequently to excess. And he underscored the importance of the Federal Reserve as a lender of last resort.” Hyman Minsky’s model of the credit system, which he dubbed the “financial instability hypothesis” (FIH), incorporated many ideas already circulated by John Stuart Mill, Alfred Marshall, Knut Wicksell and Irving Fisher. “A fundamental characteristic of our economy,” Minsky wrote in 1974, “is that the financial system swings between robustness and fragility and these swings are an integral part of the process that generates business cycles.”

Disagreeing with many mainstream economists of the day, he argued that these swings, and the booms and busts that can accompany them, are inevitable in a so-called free market economy – unless government steps in to control them, through regulation, central bankaction and other tools. Such mechanisms did in fact come into existence in response to crises such as the Panic of 1907 and the Great Depression. Minsky opposed the deregulation that characterized the 1980s. It was at the University of California, Berkeley that seminars attended by Bank of America executives helped him to develop his theories about lending and economic activity, views he laid out in two books, John Maynard Keynes (1975), a classic study of the economist and his contributions, and Stabilizing an Unstable Economy (1986), and more than a hundred professional articles. Hyman Minsky’s theories have enjoyed some popularity, but have had little influence in mainstream economics or in central bank policy. Hyman Minsky stated his theories verbally, and did not build mathematical models based on them. Minsky preferred to use interlocking balance sheets rather than math equations to model economies: “The alternative to beginning one’s theorizing about capitalist economies by positing utility functions over the reals and production functions with something labeled K (called capital) is to begin with the interlocking balance sheets of the economy.” Consequently, his theories have not been incorporated into mainstream economic models, which do not include private debt as a factor. Minsky’s theories, which emphasize the macroeconomic dangers of speculative bubbles in asset prices, have also not been incorporated into central bank policy. However, in the wake of the financial crisis of 2007–2010 there has been increased interest in policy implications of his theories, with some central bankers advocating that central bank policy include a Minsky factor.

Born

- September, 23, 1919

- USA

- Chicago, Illinois

Died

- October, 24, 1996

- USA

- Rhinebeck, New York